St. Louis Car Accident Lawyer

Car accidents are a harsh reality of life that can leave victims struggling with medical bills, lost earnings, and pain and suffering. In unfortunate situations, victims may even be pronounced dead despite receiving medical treatment. If you’ve been in a car accident in St. Louis, it’s important to know that you may be entitled to compensation from the at-fault driver and their insurance company. However, proving liability in a car accident case can be challenging.

This article explains what you need to know about proving negligence and comparative negligence in a car accident case and what happens if the defendant received a ticket. Are you looking for the best car accident lawyer in St. Louis? Look no further than The Mutrux Firm Injury Lawyers. By contacting a 5 star rated attorney, we can help guide you in the right direction for your legal matter.

St. Louis Car Accident Statistics

Each year, the number of accidents on Missouri roadways increases exponentially every year. This is an unfortunate statistic that we know all too well.

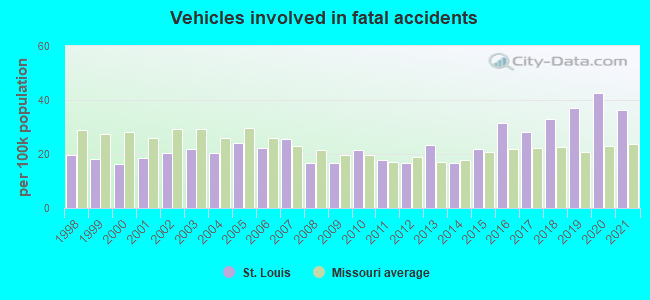

To really get a grasp of the car accidents in St. Louis and Missouri as a whole, check out this graph by City Data that outlines fatal crashes throughout the state:

Locations and Causes of Fatal Crashes in St. Louis County

Lethal collisions could happen anywhere in the county, but fatal incidents most commonly occur on major highways like Interstates 270, 170 and I-7. Interstate 270, for example, is widely known as one of the most dangerous roadways in the country. Its high speed-limit and traffic density can be problematic for many drivers.

Analyzing evidence can reveal patterns and demonstrate the most common causes of fatal car accidents. Typical causes of these wrecks include but are not limited to:

- Intersection crashes;

- High speed impacts;

- Rear impact collisions;

- Tractor-trailer incidents;

- Commercial vehicle wrecks.

Any combination of these automobile crashes could have disastrous consequences for innocent motorists. If the collision was caused by the negligence or recklessness of another driver, the family of the decedent might have multiple options available. A compassionate attorney in St. Louis County could analyze the lethal crash to determine whether a wrongful death lawsuit is a valid next step.

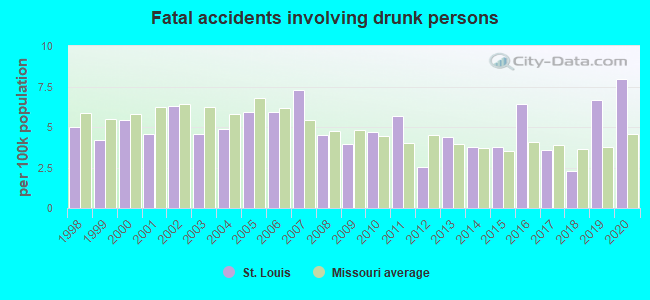

DUIs are another unfortunate fact when it comes to car accidents. The sheer amount of accidents due to a DUI driver are quite staggering. Courtesy of City Data:

The Missouri Department of Transportation (MoDOT) analyzes car accident statistics annually. These statistics show us the frequency, nature, and causes of car accidents throughout St. Louis. Factors such as high population density, varied traffic conditions, diverse weather patterns, and driver behavior contribute to car accidents.

This data tells us the types of accidents that occur in the city, the number of injuries and fatalities, and key factors like distracted driving or speeding that significantly impact road safety. Understanding these statistics is pivotal for authorities and residents alike, serving as a foundation for targeted interventions and initiatives aimed at enhancing road safety and reducing accidents in St. Louis.

St. Louis has over 300,000 residents living in the city; therefore, thousands of vehicles are on the road at any given time. St. Louis is also the melting pot of three interstate highways, and is a popular hub for tourists. The statistics for car accidents in St. Louis are staggering, let’s check out the stats below:

- According to Trailnet, in 2021 alone, there were up to 178 people killed and more than 14,000 people injured in St. Louis County.

- This would be the fourth year in a row that the number of people walking who were killed increased as a result of vehicle negligence

- Car accidents in St. Louis continue to increase year over year, as they increased exponentially in 2021 when compared to 2020.

In addition to passenger vehicle accidents, there were a number of accidents from other road users as well. The 2021 numbers for traffic accidents are quite staggering in St. Louis, as there were up to 15,042 accidents. 7,332 of those accidents were from other road users, such as:

- 692 semi-truck accidents

- 1534 motorcycle accidents

- 59 bicycle accidents

- 210 pedestrian accidents

Which Roads and Intersections are The Most Dangerous in St. Louis?

We’ve been a leading St. Louis car accident lawyer for over ten years, so we have an idea of the most dangerous roads and intersections in St. Louis County.

Car accidents can occur across almost every area of the city in St. Louis, but certain areas often see higher accident rates. Intersections along major thoroughfares, such as Interstate highways, densely populated urban streets, and areas with heavy commuter traffic, tend to have higher accident rates. Specific locations might include major intersections like Kingshighway Boulevard and Natural Bridge Avenue or Gravois Avenue and Chippewa Street, among others.

Additionally, areas around downtown, where traffic volume is typically higher is a hotspot for car accidents in St. Louis. Factors such as increased congestion, traffic light patterns, road design, and frequent lane changes can contribute to accident hotspots. Analyzing local accident data and reports from authorities like the Missouri Department of Transportation (MoDOT) or the St. Louis Metropolitan Police Department can provide a more precise understanding of the exact locations where most accidents occur within the city.

Some of the most dangerous roads include:

- Galleria Pkwy and South Brentwood Blvd in Brentwood and Richmond Heights

- Price Rd and MO Route D in Overland

- Green Park Rd and Reavis Barracks Rd in South St. Louis County

- MO Route 141 and South Outer Forty Rd in Town and Country

- Dunn Rd and Graham Rd in Florissant near the St. Louis Lambert Airport

- Pershall Rd and West Florissant Rd in Ferguson

- North I-270 Ramp and West Florissant Rd in Ferguson

- Gravois Bluffs Blvd and MO Route 141 in Fenton

- Chambers and West Florissant Rd in Ferguson

- Lucas & Hunt Rd and Pasadena Blvd in Northwoods

When traveling on these roads, please remember to stay alert and lessen distractions while driving. Paying attention and being aware of your surroundings could save a life.

How Can The Mutrux Firm Help You After a Car Accident?

Car accidents can be traumatic events, especially if there are injuries or death. Our St. Louis car accident lawyers can help you fight for your rights and be an advocate for you. We can help you recover any compensation owed and help you get back on track.

Mutrux Firm Injury Lawyers is a proven car crash lawyer with a track record of success for our clients. What sets us apart from the rest is the care and compassion we show towards our clients in their time of need.

Upon working with our firm, our auto accident attorneys will begin your case by taking a look at any documents, such as police reports from the scene, gather evidence, such as camera footage and eyewitness testimony, put together a comprehensive approach, and keep you informed every step of the way. Oftentimes, we will also speak with industry experts and communicate with insurance companies.

Ultimately, if a jury trial is necessary, we are not afraid to fight for you in court and will be with you every step of the way. Our St. Louis car accident lawyers and ready and able to litigate your case and advocate for your rights.

Missouri Insurance Requirements

Let’s take a look at the Missouri car insurance requirement for vehicles registered in the state. Missouri is an at-fault state, therefore, drivers must carry a minimum amount of liability coverage to their auto policies. Let’s do a quick rundown of the requirements that must be met to register and insure a vehicle in Missouri:

- Liability and uninsured motorist coverage must be added to your policy.

- You must keep proof of insurance in your vehicle while driving. Failure to present proof of insurance to a police officer could result in fines.

- Failure to have proof of insurance could lead to penalties and make it difficult to regain compensation in the event of an accident.

Minimum Car Insurance Required in Missouri

Missouri requires that all motorists have both liability coverage and uninsured motorist coverage. There are a few ways to meet these requirements, such as:

- Buying a liability policy

- Proof of financial responsibility

- Self-insurance where applicable

Liability Insurance

For liability insurance, drivers in Missouri must have the following minimum amounts of coverage:

- $25,000 per person for bodily injury

- $50,000 per accident for bodily injury, and

- $25,000 per accident for property damage.

Liability insurance is important, as it covers you in the event that you have sustained injuries, property damage, and other economic damages. Liability insurance covers any accident where you are the at-fault driver, your policy will pay for any damages caused. According to Missouri law, you must carry $25,000 per person for bodily injury coverage, and $50,000 per accident for bodily injury in uninsured motorist coverage.

Proof of Financial Responsibility

In Missouri, you have the choice to file a Proof of Financial Responsibility instead of buying an insurance policy. The Proof of Financial Responsibility must be filed with the Department of Revenue, and can submit one of the following to show you’re financially viable to pay for any damages:

- Surety bond

- Real Estate Bond

- Cash deposits or securities

Certificate of Self-Insurance

Certificate of Self-Insurance

The certificate of self-insurance is unique. Religious organizations or companies that have a fleet of at least 26 passenger vehicles are eligible to apply. Similar to the Proof of Financial Responsibility, a certificate of self-insurance must be submitted to the Department of Revenue.

What are The Penalties for Driving Without Insurance in Mo.?

Driving without insurance could lead to fines, having your license revoked, license reinstatement fees, and points on your license. Driving with insurance will help your St. Louis car accident lawyer better handle your case, and lead to a more favorable outcome.

“No Pay, No Play” Law in Missouri

The “No Pay, No Play” law prevents you from recovering non-economic damages if you were involved in an accident while driving without insurance. Non-economic damages are crucial when it comes to your St. Louis car accident case, as they could include mental anguish, loss of consortium, diminished quality of life, and more.

Tips for Dealing With a Car Insurance Claims Adjuster

Insurance adjusters are trained to provide accident victims with the least compensation possible so the company does not have to pay out large sums of money. It is important to remember that the insurance company is constantly looking out for themselves, not for their clients. Let’s check out some tips for dealing with insurance adjusters when they call you about your claim:

- Never admit fault

- You are not required to provide the adjuster with any statement

- If you have not been treated, do not discuss injuries

- Do not elaborate. Make your answers short and concise

- It’s okay not to know the answer to a question. This will not hurt your case

- Speak to your lawyer before signing any documents provided by the insurance company.

- If the initial settlement offer is too low, get in touch with an attorney right away.

Although you can speak to the adjuster yourself, we recommend letting an attorney handle the communication. Your attorney should be a skilled negotiator and know which tactics the insurance adjuster will use to save their company from paying out.

Are Car Accidents Common in St. Louis?

In St. Louis, as in many urban areas across the United States, car accidents are, unfortunately, quite common for commuters and visitors alike. The frequency of car accidents in St. Louis is influenced by many factors.

Population density plays a significant role in the prevalence of car accidents. St. Louis, being a major metropolitan area, harbors a dense population. With a higher number of residents and commuters navigating the city’s roads, the probability of car accidents naturally increases. The bustling nature of the city contributes to traffic congestion during peak hours, elevating the risk of collisions.

Traffic conditions are another crucial factor. St. Louis’s roadways consist of downtown streets and more open suburban roads. Heavy traffic not only increases the chances of accidents due to the proximity of vehicles but also adds complexity to driving, potentially leading to incidents caused by sudden lane changes, tailgating, or drivers attempting to navigate through tight spaces.

Weather also plays a pivotal role in the frequency of car accidents. St. Louis experiences varying weather patterns throughout the year, including snowfall in winter and occasional heavy rains. Inclement weather significantly impacts road conditions, reducing visibility and creating slippery surfaces. Consequently, these conditions often contribute to an upsurge in car accidents as drivers struggle to adapt their driving to these adverse conditions.

Road infrastructure and maintenance are additional elements affecting the high rate of car accidents. The condition of roads, signage, and traffic signals can impact driver safety. Poorly maintained roads, inadequate signage, or malfunctioning traffic signals can create hazardous situations, leading to accidents. Moreover, ongoing construction or road repairs can alter regular traffic patterns, posing challenges to drivers and increasing the likelihood of accidents.

Driver behavior is perhaps one of the most critical factors contributing to the frequency of car accidents in St. Louis. Distracted driving, speeding, driving under the influence of alcohol or drugs, and disregarding traffic laws all contribute to car accidents. Instances of distracted driving, such as texting or using smartphones while driving, have become a growing concern and a leading cause of accidents not only in St. Louis but nationwide.

To gain a comprehensive understanding of the frequency and nature of car accidents in St. Louis, taking a look at annual crash statistics and reports from the Missouri Department of Transportation (MoDOT) is essential. These reports offer detailed insights into the number of accidents, their causes, locations with higher incident rates, and trends over time. They provide a valuable resource for authorities to identify problem areas and implement targeted measures to enhance road safety.

Do you need a car crash lawyer? Have you been involved in a car accident? Get in touch with our St. Louis car accident attorney at Mutrux Firm Injury Law today! We’re here to fight for you every step of the way.

What Is My Car Accident Case Worth in St. Louis?

There are various factors that determine how much your St. Louis car accident case is worth. From the severity of injuries to the extent of property damage and the circumstances of the accident, several elements play a crucial role in assessing the case’s value.

- Extent of Injuries: The severity and nature of injuries sustained in the accident significantly impact the case’s value. More severe injuries requiring extensive medical treatment or surgeries or resulting in long-term disabilities tend to increase the case’s worth. Medical records, bills, and expert opinions help determine the value based on the medical expenses incurred and the impact the injuries have on your quality of life.

- Property Damage: Evaluating the damage to your vehicle and any other property involved in the accident is essential. The cost of repair or replacement provides a tangible figure for compensation.

- Liability: Determining fault or liability in the accident is crucial in Missouri, which follows a comparative fault system. If you share some responsibility for the accident, your compensation might be reduced proportionally. Clear evidence establishing the other party’s negligence strengthens your case.

- Lost Wages and Future Earnings: If the injuries caused you to miss work or affected your ability to earn in the future, these financial losses factor into the case’s value.

- Pain and Suffering: Non-economic damages like physical pain, emotional distress, and loss of enjoyment of life are challenging to quantify but are important aspects of compensation. They often require subjective evaluation based on the impact of the accident on your daily life and well-being.

- Insurance Policy Limits: The liable party’s insurance coverage can also impact the case’s value. If the at-fault driver has limited coverage, it might affect the maximum compensation you can receive.

- Statute of Limitations: Missouri has a statute of limitations that dictates the time you can file a lawsuit. Failing to meet this deadline could jeopardize your case.

To estimate your case’s overall value, consider consulting with a St. Louis car accident attorney. We can evaluate the specifics of your situation, review evidence, and apply our experience to estimate a potential settlement or court award.

It’s crucial to document all accident-related expenses meticulously, including medical bills, repair receipts, and any other costs incurred due to the accident. Additionally, keeping a record of how the accident has impacted your daily life, activities, and emotional well-being can strengthen your case.

Remember, each case is unique, and multiple variables contribute to its value. An attorney experienced in handling car accident cases in St. Louis can provide personalized guidance and help you navigate the legal process.

What Damages Am I Entitled To in St. Louis?

Car accident victims may be eligible for different types of damages to compensate for their losses. These damages fall into two primary categories: economic and non-economic.

- Economic Damages: These damages are tangible, quantifiable losses resulting from the accident:

- Medical Expenses: Covering all past and future medical bills related to the accident, including hospital stays, surgeries, rehabilitation, medication, and therapy.

- Lost Income: Compensation for wages lost due to missed work during recovery. Future lost earning capacity might also be considered if the injuries affect the victim’s ability to work.

- Property Damage: Reimbursement for the repair or replacement of the damaged vehicle or other property involved in the accident.

- Cost of Services: If the accident causes a need for household or caregiving services, these expenses may also be included.

- Non-Economic Damages: These damages are less tangible but equally impactful:

- Pain and Suffering: Compensation for physical pain, emotional distress, and mental anguish resulting from the accident and injuries sustained.

- Loss of Enjoyment of Life: Compensation for the inability to participate in activities or hobbies enjoyed before the accident due to injuries or limitations caused by the accident.

- Loss of Consortium: This compensates for the negative impact the injuries have on the victim’s relationship with their spouse or family members.

- Disfigurement or Scarring: Compensation for any permanent physical changes resulting from the accident.

- Punitive Damages: In cases of extreme negligence or intentional harm, punitive damages may be awarded to punish the at-fault party and deter similar behavior in the future.

The availability and amount of these damages vary based on the specific circumstances of the accident, the severity of injuries, liability factors, and the jurisdiction’s laws. Consulting with a qualified attorney who specializes in car accident cases can guide on what damages may apply in your situation and how to pursue fair compensation.

If you have been involved in a car accident, our St. Louis car accident lawyers can help you navigate the legal process from beginning to end. You can trust us to get you the compensation that you deserve.

Learn more with lawyer Tyson on who pays for your treatment after a car crash:

Who Is Liable for My Car Accident in St. Louis?

When a car accident occurs in St. Louis, there are quite a few parties that could be held liable for your injuries and property damage. In the case where your injuries far exceed the limits on your insurance policy, you will likely have to file suit.

In Missouri, you can file against any party who might share some of the fault in your car accident, such as:

- Drivers of other passenger vehicles

- The driver of your car

- Your own passenger

- Truck drivers

- Trucking companies

- Motorcyclists

- Bicyclists

- Pedestrians

- Bus drivers

- Public transportation companies companies

- Employers of negligent parties

- Vehicle manufacturers

- Company or private mechanics

- Lyft and Uber drivers

- Taxi drivers

- Cab companies

- Government entities

As you can see, there are quite a few parties that could be at fault for your accident. Therefore, it is important to seek legal counsel from a St. Louis car accident lawyer to fully investigate your case, and get you the compensation you deserve.

Common Fact Patterns in a Hit-and-Run Case

Hit and run accidents in St. Louis County happen for a variety of reasons. The most common reason a person runs from the scene of an accident is because they have a warrant out for their arrest, or they do not have auto insurance and are afraid of being personally liable for the crash.

In other cases, the driver may have been unaware because they were incapacitated or under the influence of drugs. These types of hit and run accidents frequently occur in areas were involving a high density of street parking. A hit and run accident claimant could work with a knowledgeable St. Louis County attorney to determine the exact cause of their crash and pinpoint the best next steps.

Unique Aspects of a Hit and Run Case

Hit and run accident cases are different from other types of car accident cases. The main reason is that plaintiffs are usually not able to locate the driver that hit them. This means that the case will be run through their insurance as an uninsured motorist claim. Although the other driver may have been insured, they are deemed as an uninsured motorist under their insurance policy’s phantom driver coverage. This is a coverage that is on every policy in the state of Missouri.

Other unique aspects of hit and run injury claims involve criminal charges. In most cases, the defendant may face hit and run charges. If a defendant is found to be guilty in a criminal trial, the claimant may use that information as evidence in pursuit of compensation. A seasoned St. Louis County lawyer understands what makes hit and run cases unique and could fight to maintain an accident victim’s entitlement to justice.

Common Fact Patterns Regarding St Louis Rollover Accident

Rollover car crashes occur frequently in St Louis County. There are several ways in which these types of accident could occur. For example, rollover accidents typically involve vehicles moving at high speeds. If the unsuspecting driver is tapped on its side, the driver could overcorrect their vehicle, causing the car to flip due to momentum. Other causes involve drivers failing to yield at an intersection. Although these collisions occur at relatively lower speeds, vehicles may still be at risk of flipping over if they are hit hard enough.

Unique Aspects of Rollover Accidents

One of the more common things seen in rollover accidents is the extent of the damages. Victims are known to suffer excruciating injuries which could take the22m weeks, months, and even years to recover from. In addition, it is more than likely that the victim’s vehicle is totaled as a result from the accident or sustain significant property damage. In the end, the victim will not only have to worry about their medical costs, but they would also have to figure out how much they would have to suspend to fix the property damage.

Documenting Evidence Following an Accident

A person should document a rollover accident like any other type of car crash. They should get statements from witnesses, collect photos and videos, and make sure they obtain a copy of the police report. It is also crucial that they document their medical treatment so their attorney can collect all the necessary medical records and billing statements. With the help of a rollover accident lawyer in St. Louis, a victim could gather all evidence necessary for filing a successful injury claim.

Preventing a Rollover Accident

While rollover accidents can sometimes be unpredictable, there are some steps an individual can take to help prevent them. The first is driving safely for the weather conditions. If there is ice or snow on the ground, then they should drive slower. Drivers should also maintain a safe speed at all times and not exceed the speed limit. Also, when on the interstate, drivers should avoid larger vehicles and avoid driving in a tractor trailer’s blind spot.

Sometimes, a rollover accident is unpreventable. This is typically because one driver does not see it coming. The impact tends to be from the side or in the driver’s blind spot. Vehicle malfunctions can also cause rollover crashes. An example of that is when a tire or wheel comes off a vehicle, causing the vehicle to overturn.

What Happens When There are Multiple Defendants in a Car Accident Case in St. Louis?

Car accident victims who have suffered substantial losses as a result of another person’s negligence should feel the need to take legal action to recoup their damages. However, in some cases, victims may be encouraged to take action against several parties if they all contributed to their injuries. When this occurs, it is important that the rights steps are taken early on.

Having multiple defendants in a St. Louis County car accident case could have its benefits, but just the same, it also comes with its disadvantages. To begin discussing your case, be sure to schedule a consultation today.

Litigation Process Involving Multiple Defendants

If there are multiple defendants in a trial, the process is mostly the same as if there were only one defendant. However, the process is slightly different in that the defendant will be going twice in whichever order the court chooses.

For example, the plaintiff will go first, whether it is an opening statement pointing out evidence or in closing arguments, and the defense will go second. However, when there are more than one defendant in the case the process may continue as; plaintiff, defendant, defendant in each stage of the process.

Could Having Multiple Defendants Influence the Outcome of a Case?

Having multiple defendants in a St. Louis County car crash trial can influence the outcome in a variety of ways. One strategy employed by defendants is for them to team up against the plaintiff and point the finger at that plaintiff. However, the defense rarely considers this option.

In other cases, defendants would argue amongst themselves. Although this may sound like it is beneficial to the plaintiff, it could actually harm the plaintiff’s chances of obtaining a favorable outcome because it may divide the jury panel as to who is at fault. At least nine people must be in the plaintiff’s favor for them to enter a verdict on their behalf, and if they are split three ways, they will never get to that nine-person requirement.

How Your Auto Accident Attorney Proves Negligence in a Car Accident Case

In St. Louis County, every collision is someone’s responsibility, and the aim of a car accident claim is to blame the accident on the other driver. A St. Louis car accident lawyer can help you to prove that the defendant was negligent for your personal injury claim. Examples of negligent behavior include speeding, tailgating, failing to check blind spots, failing to stop at red lights, and texting while driving. Even if the defendant didn’t violate a rule of the road, their driving may still be careless enough to warrant a negligence case. However, car accident cases in St. Louis County must also evaluate the plaintiff’s role in contributing to the accident.

Comparative Negligence in an Auto Wreck Case

Missouri has a comparative negligence statute that requires juries in negligence cases, such as car accident claims, to evaluate the actions of both parties to assign blame. If the jury believes that the plaintiff shares any of the blame for the accident, they must reduce the plaintiff’s award by that percentage of fault. As a result, plaintiffs in car accident cases must argue that the defendant was at fault and that they did not contribute to the crash. A St. Louis car accident lawyer can help to explain the important legal concepts and build a case that names the defendant as the sole at-fault party in the crash.

What if the Defendant Received a Ticket?

In certain situations, the actions of a police officer may simplify the analysis of a car accident case. If the defendant received a ticket, and a court finds the defendant responsible for the auto accident, St. Louis County’s personal injury laws use a legal theory called negligence per se, which recognizes that a defendant may be at fault for an accident if they committed a criminal act or violation that resulted in an injury. The state’s traffic code prohibits speeding, tailgating, failing to yield, and a dozen other dangerous driving activities. If a police officer issues the defendant a ticket for any of these violations and a court finds the defendant guilty, the civil court hearing the case for damages may assume that the defendant is negligent and 100 percent responsible for the plaintiff’s losses.

Car Accident Victims in Critical Condition

Car accidents can cause a range of injuries, from minor bruises to life-threatening conditions. In some cases, car accident victims may be in critical condition and require immediate medical attention. This can result in significant medical expenses, loss of income, and emotional trauma. If you or a loved one is in critical condition as a result of a motor vehicle accident, it’s important to seek legal assistance from a St. Louis car accident attorney. An attorney can help you navigate the legal process and ensure that you receive the compensation you deserve.

Filing a Police Report after a Motor Vehicle Accident

After a motor vehicle accident, it’s important to file a police report as soon as possible. In Missouri, the Missouri State Highway Patrol is responsible for investigating motor vehicle accidents that occur on state highways. The police report will contain important information about the accident, such as the location, time, and date of the accident, the names and contact information of the drivers involved, and any witnesses to the accident. This information can be crucial in building a strong case and proving negligence on the part of the at-fault driver.

How the Missouri State Highway Patrol Can Help

The Missouri State Highway Patrol can provide valuable assistance to car accident victims. They can investigate the accident, collect evidence, and interview witnesses. They can also provide guidance on how to file a car accident claim and what steps to take to protect your legal rights. If you’ve been involved in a car accident in Missouri, contact the Missouri State Highway Patrol to report the accident and obtain assistance. They can help you navigate the process of filing a claim and ensure that you receive the compensation you deserve.

How Much Does It Cost To Hire a St. Louis Car Accident Lawyer?

At the Mutrux Firm, we work on a contingency basis, meaning that you don’t owe us a dime unless we win. Practicing law on a contingency basis aligns with our belief that every car accident victim deserves the representation of legal counsel, regardless of their ability to pay. Once we settle your case, we will just take a percentage of the award for the firm, leaving you with the rest to get your life back on track. In this video, lawyer Tyson talks more about what happens after your settlement check arrives at our office:

Contact The Best St. Louis Car Accident Lawyer Today!

We have been rated one of the best car accident lawyers in St. Louis, and are ready to fight for you. If you or a loved one has been injured in a car accident or pronounced dead as a result of an auto accident, contact our experienced St. Louis car accident attorneys today. We can help you build a powerful case against a negligent defendant, demand fair payments for your injuries or loss, and represent your interests every step of the way. Keep in mind that the statute of limitations for filing a car accident claim in Missouri is five years from the date of the accident, so don’t delay in contacting us for a free consultation. A St. Louis County Car Crash Lawyer can help you navigate the process. Contact the Mutrux Firm Injury Lawyers today!

St. Louis Car Accident Lawyer FAQs

There are quite a few common questions we receive when it comes to car accident cases. Whether it be about filing a claim, whether to accept settlements, or when to hire an attorney, you can find the answers to all of your questions below.

How long do you have to report a car accident to your insurance?

In most cases, the terms of your policy will dictate how long you have to report your accident to insurance. It is critical to know the terms of your insurance policy so you can report the accident in adherence to the terms of your policy. Reporting your accident after the amount of time described in your policy could cause them to deny you coverage later.

How long after a car accident can you file a lawsuit?

The statute of limitations in Missouri states that you have five years from the date of the accident to file suit. Failure to file suit within the statute could hinder your chances of receiving compensation, and you might be left to pay for your medical expenses and property damage. Therefore, it is very important to file within the statute to recover the damages you are owed.

How do insurance companies settle auto claims?

After the demand letter is sent, insurance companies settle auto claims by negotiating with the claim holder and their attorney, if present. It’s common for insurance companies to want to settle for the least amount possible, which is where your attorney comes in and negotiates on your behalf. In most cases, even though they may seem genuine, they are not looking out for your best interest.

How long does it take to get a settlement from a car accident?

How long it takes to get a settlement from a car accident varies on the nature of the case. Details of the case such as the severity of the injuries, complexities of the property damage, and medical expenses all play a significant role. It also depends on the insurance company and how they view your injuries. If they feel you are making your injuries out to be worse than they actually are, settlement will take longer. If this is the case, you might be able to claim bad faith on the insurer.

Do I have to accept the settlement that is offered?

No. If you believe the settlement offered does not cover your damages, you do not have to accept that settlement. Keep an eye out for the insurance company’s first offer, and this is usually the lowest they try to get you to settle for. If the initial offer is low, and you feel you are not being treated fairly by your insurance provider, you should get in touch with a qualified attorney and file a lawsuit.

How to File a Fatal Car Wreck Claim and Collect Compensation

After a legal representative establishes that a lethal car collision was caused by the careless actions of another motorist, a family can begin filing a wrongful death claim to collect money.

The process of submitting a lawsuit begins with ensuring that the right person brings it to court. In Missouri, the children, spouse, or parents of the decedent are the only ones able to initiate a wrongful death action. Cases are usually stronger when these parties work together to construct a compelling argument.

Compensation in fatal wreck cases can be substantial and repayments usually align with the typical wrongful death reimbursement. Common examples of money damages in these cases include coverage for lost wages and loss of earning capacity, medical expenses, or loss of consortium. However, if a claimant can prove that the guilty was navigating maliciously or illegally, they could invoke punitive damages for the wrongful conduct. The defendant might also face jail time or further legal consequences. A knowledgeable attorney in St. Louis County could thoroughly assess the details of a fatal car accident to maximize financial compensation.

What are The First Steps to Take Following a Major Roadway Accident?

When someone is involved in an interstate accident, the first thing they should do is pull over to the side of the road. Once they have gotten to safety, the next thing they should do is call 911 and wait for police. Law enforcement on the scene could get insurance information from all parties and interview any witnesses to the crash. This information would be recorded in a police report. Victims should try to obtain the police report and use it as evidence to back up their claim for compensation.

Victims should also allow a medical examiner to check for injuries. By doing so, victims would also be creating a legal record of their injuries which could be presented as evidence in an injury claim.

What are Some Unique Aspects of a Hit and Run Case?

Hit and run accident cases are different from other types of car accident cases. The main reason is that plaintiffs are usually not able to locate the driver that hit them. This means that the case will be run through their insurance as an uninsured motorist claim. Although the other driver may have been insured, they are deemed as an uninsured motorist under their insurance policy’s phantom driver coverage. This is a coverage that is on every policy in the state of Missouri.

Other unique aspects of hit and run injury claims involve criminal charges. In most cases, the defendant may face hit and run charges. If a defendant is found to be guilty in a criminal trial, the claimant may use that information as evidence in pursuit of compensation. A seasoned St. Louis County lawyer understands what makes hit and run cases unique and could fight to maintain an accident victim's entitlement to justice.

What are Some Examples of Parking Lot Crashes?

Although parking lots have clear lines for parking spaces and directions, drivers do not always follow them. Backing out of parking spaces also is a common source of accidents, as drivers may have reduced sightlines and misjudge the distance between them and oncoming vehicles. In this situation, unless the oncoming vehicle was traveling recklessly or at a high rate of speed, the driver of the car backing out is likely to be at fault.

Another common parking lot accident may occur when a motorist in a parking lane stops suddenly, perhaps to wait for an oncoming vehicle or another vehicle backing out of a parking place. The sudden stop may cause the car behind the driver to rear-end the first driver. In rear-end collisions, drivers must maintain a safe distance between their vehicles and the vehicles in front of them. As a result, drivers who rear-end a car in front of them likely are at fault for the accident.

Another type of parking lot accident may occur when a driver suddenly turns in front of an oncoming vehicle, usually to pull into a parking space. The oncoming vehicle has the right-of-way, even in a parking lot. Other drivers should wait until the approaching vehicle passes before making a turn. In this case, like a St. Louis County parking lot accident lawyer may advise, the turning drivers would bear fault for the accident.

How To Prevent Rollover Crashes in St. Louis

Rollover car crashes occur frequently in St Louis County. There are several ways in which these types of accident could occur. For example, rollover accidents typically involve vehicles moving at high speeds. If the unsuspecting driver is tapped on its side, the driver could overcorrect their vehicle, causing the car to flip due to momentum. Other causes involve drivers failing to yield at an intersection. Although these collisions occur at relatively lower speeds, vehicles may still be at risk of flipping over if they are hit hard enough.

Unique Aspects of Rollover Accidents

One of the more common things seen in rollover accidents is the extent of the damages. Victims are known to suffer excruciating injuries which could take the22m weeks, months, and even years to recover from. In addition, it is more than likely that the victim’s vehicle is totaled as a result from the accident or sustain significant property damage. In the end, the victim will not only have to worry about their medical costs, but they would also have to figure out how much they would have to suspend to fix the property damage.

Documenting Evidence Following an Accident

A person should document a rollover accident like any other type of car crash. They should get statements from witnesses, collect photos and videos, and make sure they obtain a copy of the police report. It is also crucial that they document their medical treatment so their attorney can collect all the necessary medical records and billing statements. With the help of a rollover accident lawyer in St. Louis, a victim could gather all evidence necessary for filing a successful injury claim.

Preventing a Rollover Accident

While rollover accidents can sometimes be unpredictable, there are some steps an individual can take to help prevent them. The first is driving safely for the weather conditions. If there is ice or snow on the ground, then they should drive slower. Drivers should also maintain a safe speed at all times and not exceed the speed limit. Also, when on the interstate, drivers should avoid larger vehicles and avoid driving in a tractor trailer’s blind spot.

Sometimes, a rollover accident is unpreventable. This is typically because one driver does not see it coming. The impact tends to be from the side or in the driver’s blind spot. Vehicle malfunctions can also cause rollover crashes. An example of that is when a tire or wheel comes off a vehicle, causing the vehicle to overturn.

What Makes a Side-Impact Crash So Dangerous?

When a vehicle strikes the side of another vehicle, there often is little between the driver or passenger and the oncoming vehicle aside from the door, which offers no protection from the impact. The oncoming vehicle is highly likely to penetrate that door and severely injure the occupant.

The unequal size of vehicles involved in the accident could also be extremely dangerous in side-impact crashes. Penetration of a much larger and heavier vehicle into a small passenger vehicle can result in catastrophic injuries, including traumatic brain injuries and spinal cord injuries. For individuals injured in these collisions, getting the advice of a side-impact car accident lawyer in St. Louis County may be highly beneficial.